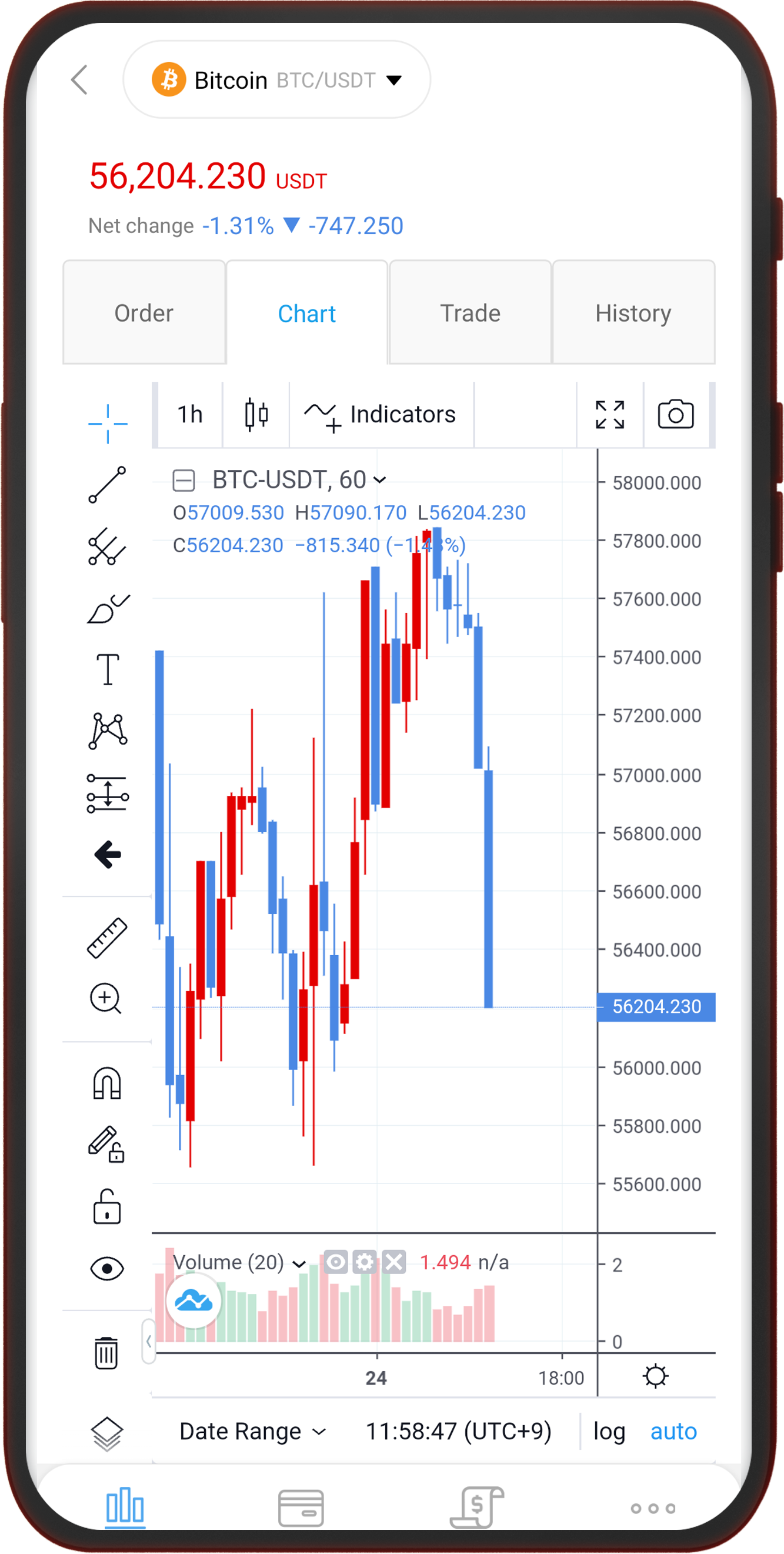

Cryptocurrency

Price

Change

Market

Strong Security

Access control is implemented by Inbound and Outbound restrictions from AWS Security Group, while Public and Private Subnet separation executes internal network blocking access

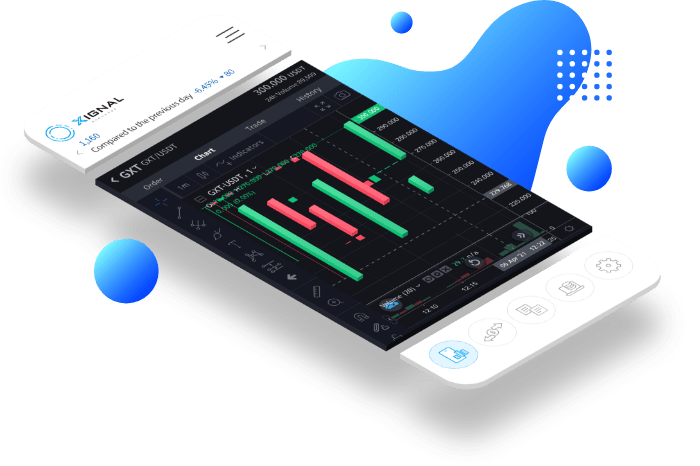

Community

We create a community for XIGNAL users. Increase your assets value through communication

INTERNATIONAL STANDARDS AND SAFETY CERTIFICATIONS

Assets are being protected with security systems certified by GDPR and ISMS.

AML/KYC

Information security system compliance with standards set by International Organization for Standardization (ISO) and International Electronical Commission (IEC).

XIGNAL Exchange Features

Strong institutional-grade security with highly encrypted whitelisted personal data.